flexibeast.space - gemlog - 2022-08-01

Is (cryptocurrency) winter coming?

No[a]. Most probably not. Unfortunately.

As the current cryptocurrency[b] crash[c] continues apace:

“Crypto collapse: Terra Luna, 3AC’s Singapore liquidation, Celsius, Voyager”

i can't help but wonder whether a ‘cryptocurrency winter’, analogous to the famous ‘AI winter’ of the 1980s, is coming.

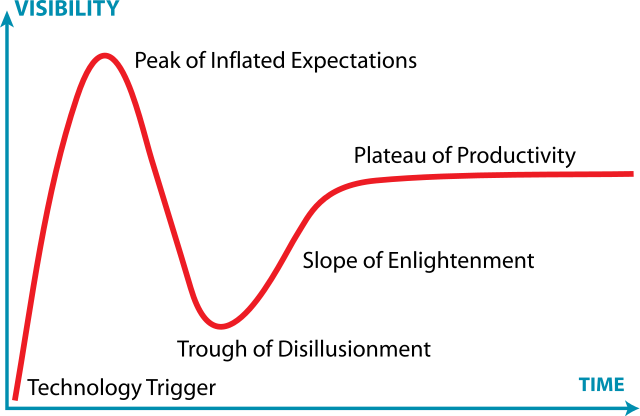

Unfortunately, however, i think it's more likely to be another short ‘trough of disillusionment’.

Image: chart of the Gartner Hype Cycle

i write “unfortunately”, not because i'm fundamentally anti-cryptocurrency in principle, but because i'm not fundamentally anti-cryptocurrency in principle. i think that the concept of cryptocurrency is an interesting one, with lots of potential for providing part of the infrastructure for sociopolitical decentralisation. However, the current state of the cryptocurrency world involves:

- Outrageous levels of energy consumption due to the dominance of Bitcoin and its specific ‘proof-of-work’ approach.

“Cambridge Bitcoin Electricity Consumption Index”

- Systematic lack of attention to the security and privacy aspects of cryptocurrencies, in terms of the code for ‘wallets’, the code for mining software, the code and system administration practices for cryptocurrency exchanges.

“Side-Channel Attack Shows Vulnerabilities Of Cryptocurrency Wallets”

“Bitcoin : Vulnerability Statistics”

“Nirvana Finance drained of $3.5 million”

- Dodgy business practices and outright lies.

“Regulators order Voyager to stop saying they're FDIC insured”

- Destructive changes to the economies of the Global South.

- Toxic right-libertarian ‘crypto bros’ who will brook no criticism of cryptocurrency, friendly or otherwise[d].

- Many cryptocurrencies effectively being Ponzi schemes[e], regardless of whether or not they've been intentionally created as such.

- “Number goes up”, i.e. that the fiat-currency value of individual cryptocurrencies will always increase, or will always increase in the medium- to long-term, and that during dips they should ‘HODL’, “Hold On for Dear Life”.

- Any criticism of cryptocurrencies is FUD from the vested interests of the feminazi-Marxist-banker-deepstate alliance that hates clever cis white male entrepreneurs getting rich.

$200 million that the country absolutely couldn’t spare has been put into bad infrastructure, dodgy public procurement contracts and bitcoins. That’s the disaster for El Salvador.

— “Your guide to the crypto crash — Terra UST, Bitcoin and El Salvador”

COBAC met on 6 May 2022 to discuss cryptocurrencies with some urgency — because the Central African Republic had just declared Bitcoin to be legal tender, without warning anyone else first.

reddit thread with audio interview: “Masculinity and Blockchain with David Gerard”

A ‘winter’ which significantly cooled the cryptocurrency bubble might allow more space for the development of cryptocurrency tech and systems more oriented towards facilitating forms of exchange much more rooted in environmental sustainability, capital circulation rather than capital accumulation, and economies which prioritise support for human thriving in general over support for the Four Monopolies[f].

Or it might not. And anyway, it feels like this is probably moot: my guess is that there are yet more cryptocurrency bubbles to come in the near future.

☙

☙

[a] Wikipedia: ‘Betteridge's law of headlines’

[b] Not ‘crypto’, which to me will always ‘cryptography’, quixotic though that may be.

[c] Amy Castor and David Gerard maintain excellent cryptocurrency-, NFT- and blockchain-focused blogs which cut through the hype:

“Attack of the 50-foot blockchain”

[d] Of course ‘crypto bros’ can't tolerate criticism of cryptocurrencies: they've bought into cryptocurrencies because they've let themselves be convinced that:

Consequently, any discussions that might diminish a bull market for cryptocurrencies are things that might actually result in crypto bros incurring very concrete losses in fiat-currency terms. Which results in phenomena like this:

I find it really interesting that the ground rules of this discussion were clearly stated at the beginning, which was that it's going to be taken as a given that crypto/blockchain is a scam and the discussion is about why men are falling for this scam; and yet you still had crypto bros trying to divert the discussion to shilling crypto.

A related reddit comment i found thought-provoking:

“I was going to comment about the gendered aspect of different schemes: Women-focused mlm's [Multi-Level Marketing schemes] seem to be attractive because they promise economic autonomy and control over one's own work while Men's schemes appeal to those who want to benefit without doing any kind of actual work.”

[e] “[A] form of fraud that lures investors and pays profits to earlier investors with funds from more recent investors. Named after Italian businessman Charles Ponzi, the scheme leads victims to believe that profits are coming from legitimate business activity (e.g., product sales or successful investments), and they remain unaware that other investors are the source of funds. A Ponzi scheme can maintain the illusion of a sustainable business as long as new investors contribute new funds, and as long as most of the investors do not demand full repayment and still believe in the non-existent assets they are purported to own.”

[f] Cf. e.g.:

“Benjamin Tucker’s Four Property Regimes and the Spirit of Capitalism”